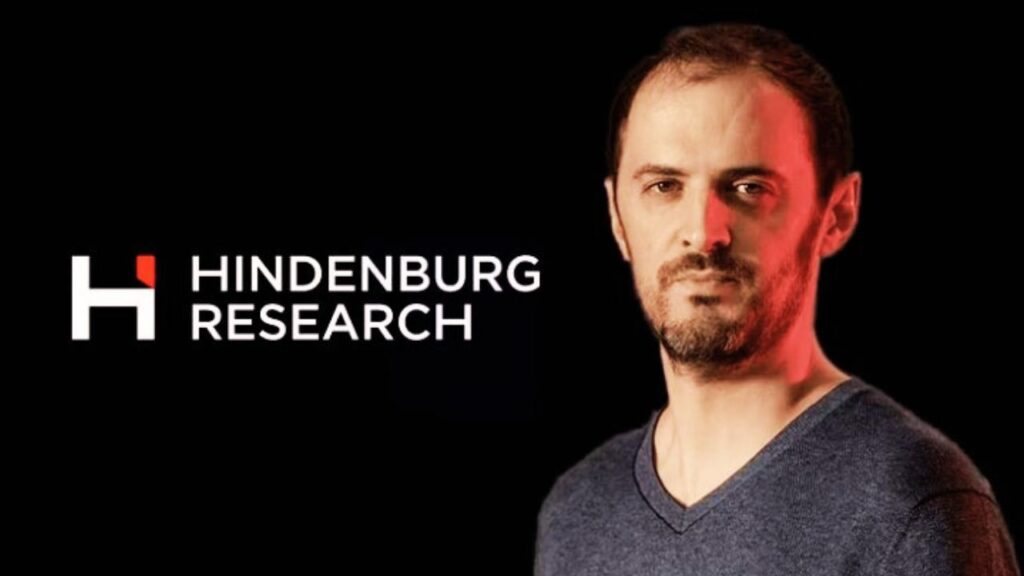

The Securities and Exchange Board of India (SEBI) has issued a show-cause notice to Hindenburg Research, its founder Nathan Anderson, and entities associated with Mauritius-based foreign portfolio investor (FPI) Mark Kingdon. This notice is related to alleged trading violations involving the shares of Adani Enterprises Ltd.

Details of the Notice

In a detailed 46-page show-cause notice, SEBI has accused Hindenburg Research and Nathan Anderson of violating several regulations. These include the SEBI Act, SEBI’s Prevention of Fraudulent and Unfair Trade Practices regulations, and the Code of Conduct for Research Analysts. Similarly, FPI Mark Kingdon has been accused of violating the SEBI Act, Prevention of Fraudulent and Unfair Trade Practices regulations, and the Code of Conduct for Foreign Portfolio Investors.

Allegations Against Hindenburg

SEBI alleges that Hindenburg and Anderson provided a misleading disclaimer in their report, claiming it was only for valuing securities traded outside India. However, the report was clearly about entities listed in India. The regulator also claims that Kingdon aided Hindenburg by indirectly participating in Adani Enterprises through collaboration in trading the company’s futures in the Indian derivatives market. Profits from these trades were reportedly shared with Hindenburg.

Hindenburg’s Defense

Despite these allegations, Hindenburg Research continues to defend its report, which was released in January 2023. The report had significant implications for Adani Enterprises, leading to considerable market activity.

Implications and Next Steps

The show-cause notice from SEBI is a crucial step in the regulatory process. It requires Hindenburg, Anderson, and Kingdon to explain their actions and address the alleged violations. Depending on their responses, SEBI may take further action, which could include penalties or other regulatory measures.

This development highlights the ongoing scrutiny and regulatory challenges faced by market participants. It underscores the importance of adhering to regulatory frameworks and the consequences of failing to do so. As the case progresses, it will be essential to monitor SEBI’s actions and the responses from Hindenburg and the other parties involved.