India’s Unified Payments Interface (UPI) set a new record in May 2024, processing 14.04 billion transactions worth Rs 20.45 lakh crore (Rs 20.45 trillion). This data comes from the National Payments Corporation of India (NPCI). The achievement marks a 5% increase in transaction volume and a 4% rise in value compared to April 2024. This makes May the highest month in both volume and value since UPI started in April 2016.

Comparing Growth to Previous Months

In April 2024, UPI transactions slightly dipped with 13.3 billion transactions, down 1% from 13.44 billion in March. The transaction value also fell by 0.7%, from Rs 19.78 trillion in March to Rs 19.64 trillion in April. The surge in May represents a significant recovery and highlights the ongoing growth of digital payments in India. Compared to May of the previous year, there was a 49% increase in transaction volume and a 39% rise in transaction value.

Changes in Other Payment Systems

Other payment systems also showed changes in May 2024. The Immediate Payment Service (IMPS) saw a 1.45% increase in volume to 558 million transactions and a 2.36% increase in value to Rs 6.06 trillion. FASTag transactions rose by 6% in volume to 347 million and by 4% in value to Rs 5,908 crore. However, Aadhaar Enabled Payment System (AePS) transactions declined by 4% in volume to 90 million and by 7% in value to Rs 23,417 crore.

UPI’s International Expansion

NPCI and the Reserve Bank of India (RBI) are working on expanding UPI’s reach both within India and internationally. UPI services are currently available in countries such as Singapore, Malaysia, UAE, France, Nepal, the UK, Mauritius, and Sri Lanka. The goal is to expand to 20 countries by FY29. In FY24, nearly four out of five digital payments in India were made via UPI. The RBI is engaging with stakeholders to scale up UPI infrastructure and integrate more users into the digital payment system.

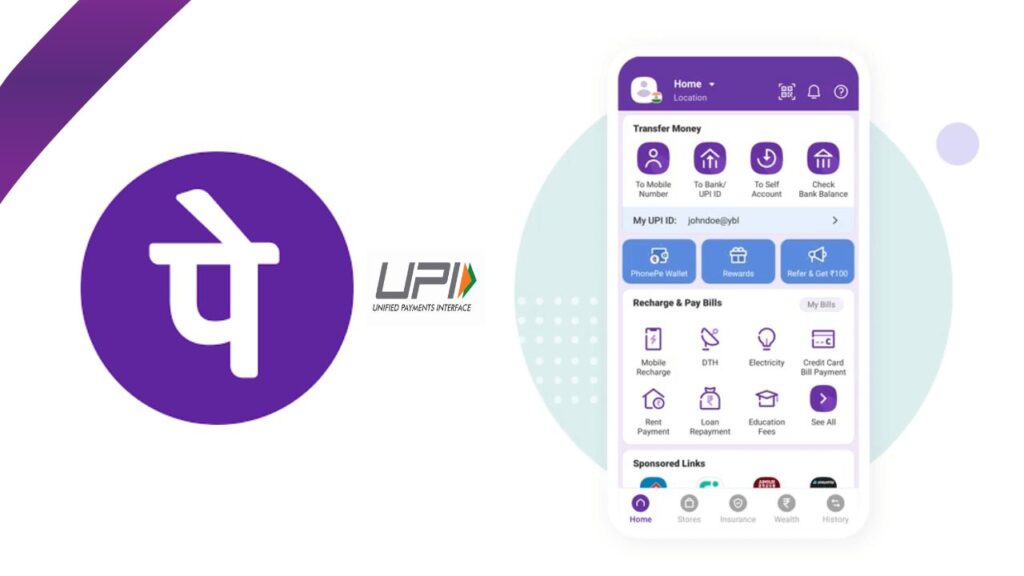

Dominance of PhonePe in the UPI Market

As of April 2024, PhonePe held the largest market share in the UPI ecosystem at 48.87%, followed by Google Pay at 37.5% and Paytm at 8.3%. In terms of transaction value, PhonePe accounted for nearly 51%, Google Pay for 35%, and Paytm for 5%. NPCI is considering a review of the 30% market share cap on UPI apps by the end of 2024. Major industry players like Adani Group and Reliance Group are also planning to enter the UPI and digital banking space, with Adani Group seeking a UPI license and Jio Financial launching a new app called JioFinance.

India’s UPI continues to grow rapidly, setting new records and expanding both domestically and internationally. With strong support from NPCI and RBI, and significant market activity from major players like PhonePe, Google Pay, and Paytm, UPI is solidifying its position as a leader in the digital payments space.