One 97 Communications, the parent company of Paytm, has denied rumors about the Adani Group acquiring a stake in the company. This statement came in response to a report by the Times of India.

What Happened?

The Times of India had suggested that the Adani Group was in discussions with Vijay Shekhar Sharma, the founder of Paytm, to buy a stake in the company. The report claimed that Sharma had met with Gautam Adani, the chairman of Adani Group, in Ahmedabad to discuss the potential deal. Another report on Tuesday indicated that the Adani Group was planning to enter the payments and e-commerce sectors. Acquiring Paytm, a leader in digital payments, could have provided the Adani Group a significant advantage in the fintech space.

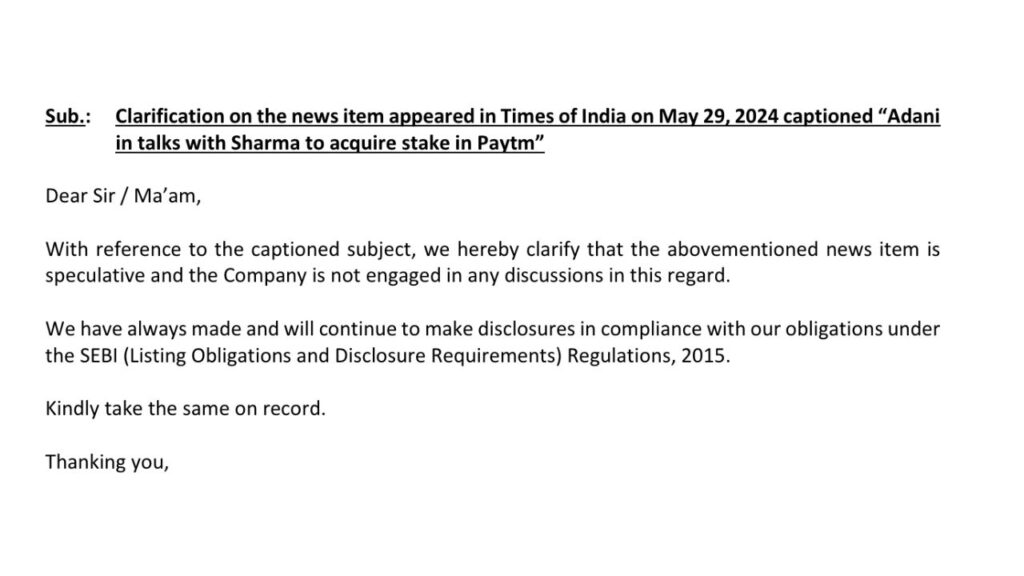

However, Paytm quickly responded to these rumors by sending a letter to the stock exchanges, firmly denying the news. The company stated that there were no ongoing talks with the Adani Group regarding any stake acquisition.

Context and Impact

The speculation about the Adani Group’s interest in Paytm surfaced at a time when Paytm was experiencing financial challenges and facing regulatory scrutiny. The company’s earnings for the March quarter had been significantly affected by these issues, and it anticipated further difficulties in the June quarter.

Despite these challenges, the news of a potential acquisition by the Adani Group had an immediate positive impact on Paytm’s stock price. As the market opened on Wednesday, Paytm’s share price hit the 5% upper circuit, reaching ₹359.45.

Market Reaction

The swift rise in Paytm’s share price reflects the market’s interest and potential optimism about the rumored acquisition. Although the rumors were denied, the mere speculation of such a high-profile deal was enough to boost investor confidence temporarily.

Paytm has denied the rumors about the Adani Group acquiring a stake in the company. This clarification came in response to a report suggesting discussions between Paytm’s founder and Adani Group’s chairman. Despite the denial, the speculation had a positive effect on Paytm’s share price, which surged by 5% as the market opened. This incident highlights the significant impact that acquisition rumors can have on a company’s stock performance, even in the face of financial and regulatory challenges.