Cred, the innovative credit card payment platform, is making waves in the personal finance sector with the launch of its new investment feature. This addition aims to simplify wealth management for millennials in India, offering them tailored investment options that are both accessible and easy to understand.

Recognizing the growing need for effective financial planning among young adults, Cred has developed a suite of investment products that cater specifically to the needs and preferences of millennials. These products range from different premium features from mutual funds to fixed deposits, allowing users to diversify their investment portfolios effortlessly through the Cred app.

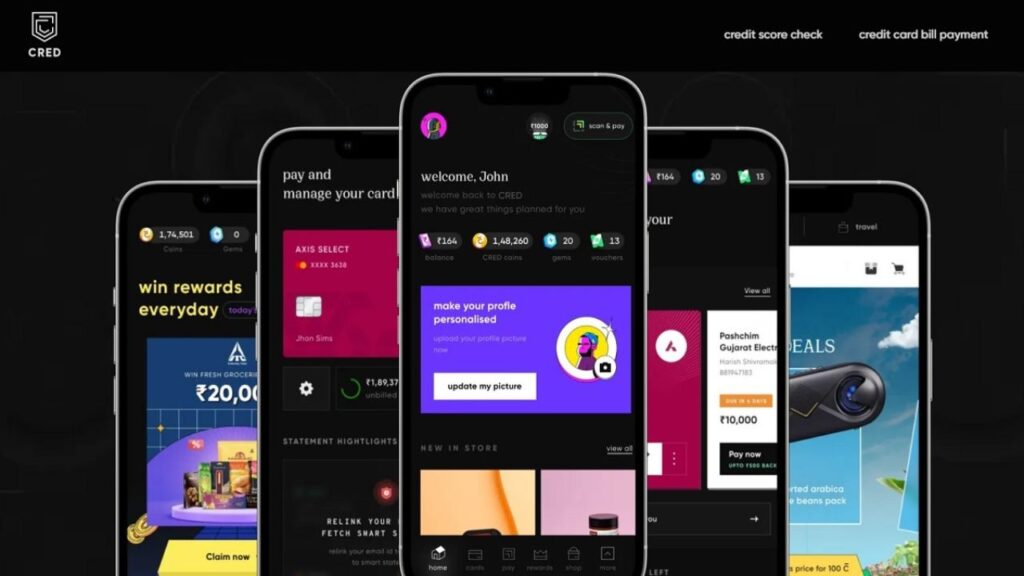

One of the standout aspects of Cred’s investment feature is its user-friendly interface. The platform provides personalized investment recommendations based on individual financial goals and risk appetite. This guidance helps users make informed decisions without the complexities typically associated with traditional investment avenues.

Moreover, Cred leverages its existing technological infrastructure to ensure a seamless and secure investment process. Users can invest directly from their linked bank accounts, track their portfolio performance in real-time, and receive expert insights to optimize their investment strategies. This integration of technology and finance makes wealth management more accessible to a broader audience.

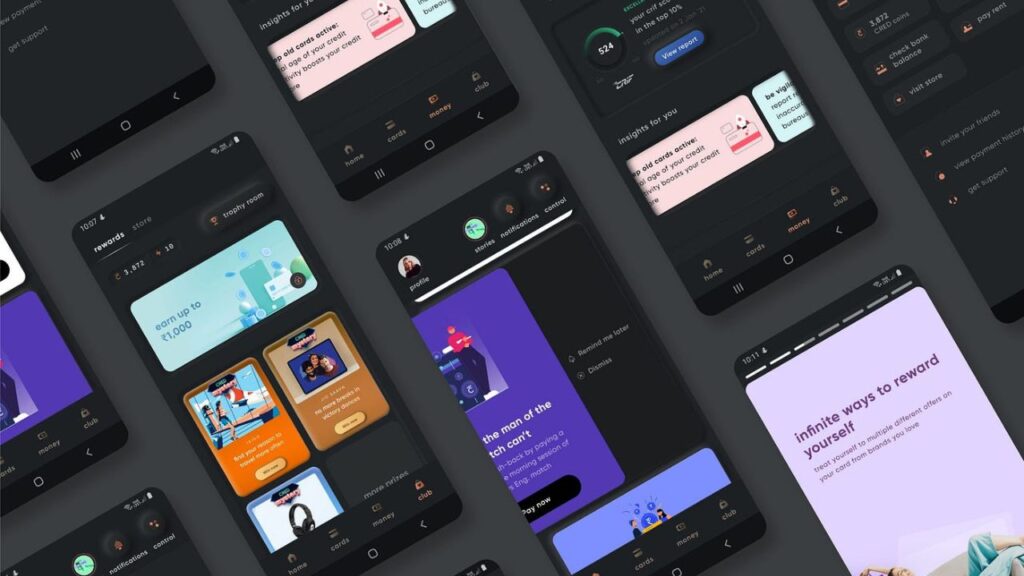

Cred’s investment feature also emphasizes transparency and education. The platform offers a wealth of resources, including articles, tutorials, and webinars, to help users enhance their financial literacy. By empowering millennials with knowledge, Cred is fostering a more financially savvy generation that is better equipped to manage their wealth.

In addition to its investment offerings, Cred continues to innovate in other areas of personal finance. Its rewards program, for instance, incentivizes timely credit card payments, encouraging responsible financial behavior among users. This holistic approach to personal finance positions Cred as a comprehensive solution for managing both spending and savings.

Overall, Cred’s new investment feature marks a significant step forward in the fintech landscape in India. By simplifying wealth management and making it more accessible, Cred is helping millennials take control of their financial futures and achieve their long-term financial goals.