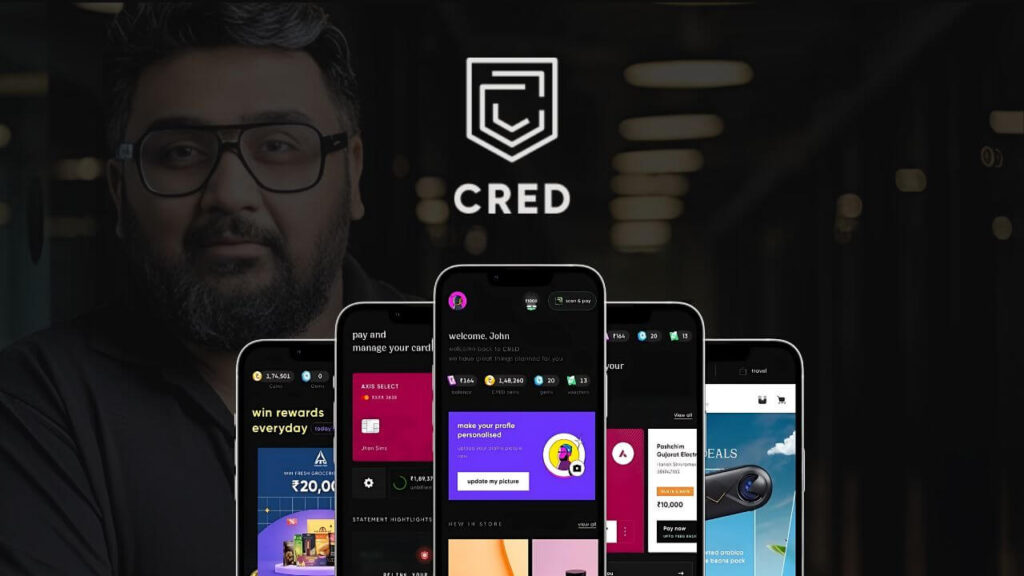

Fintech unicorn CRED has entered the RuPay credit card segment with a co-branded launch in partnership with IndusInd Bank. The new offering marks an expansion of its lifestyle-driven financial products.

The CRED IndusInd Bank RuPay Credit Card is designed for mass-affluent consumers, delivering 5% rewards on all e-commerce spends and 1% rewards on offline transactions. Users can instantly redeem their benefits across flights, hotels, 500+ merchant partners, and CRED’s growing ecosystem of services.

Sovereign Membership

Alongside the card, CRED introduced Sovereign, an exclusive invite-only membership society anchored by a bespoke 18K gold-etched credential card. The program caters to India’s most influential individuals, offering privileges beyond traditional credit cards.

Members gain access to startup investment syndicates, rare global assets, elite travel programs, curated sporting and cultural experiences, and even civilian spaceflight opportunities. This move signals CRED’s ambition to blend finance with lifestyle and aspiration.

Market Positioning Challenges

CRED’s return to its “invite-only” approach with Sovereign mirrors its early strategy during launch. However, industry observers suggest that pairing with IndusInd Bank may not carry the same premium perception as global or luxury banking brands.

In a market crowded with super-premium cards and influencer-driven recommendations, CRED will face challenges in creating enough desire and differentiation. The rising cost of customer acquisition adds another layer of complexity, especially when competing against global financial heavyweights already active in this segment.

CRED’s Current Standing

As of June 2024, CRED has over 13 million monthly active users. According to data from TheKredible, the company has raised more than $1 billion across nine funding rounds. In May 2025, it secured $75 million in a down round led by GIC, reducing its valuation from $6.4 billion in 2022 to $3.64 billion.

While CRED’s revenue grew 66% year-on-year to Rs 2,473 crore in FY24, net losses also widened by 22% to Rs 1,644 crore. The company remains optimistic about achieving profitability in FY26.

RuPay and UPI

The decision to launch the card on the RuPay network ties into India’s growing fintech ecosystem, particularly its integration with UPI. RuPay’s domestic advantage gives the card broader acceptance and allows seamless linking with UPI-based payments, making it both accessible and future-ready.

This alignment highlights how fintech players like CRED are blending global aspirations with India-first payment solutions. As UPI continues to dominate digital payments, RuPay-backed cards offer a natural extension for users seeking rewards and credit flexibility without losing local convenience.

Looking Ahead

CRED’s dual launch—the RuPay credit card for mass-affluent users and the Sovereign membership for elite customers—marks a divergent strategy targeting two very different segments. The brand aims to strengthen its identity not only as a payment solution but also as a lifestyle enabler.

Whether this strategy creates the desired exclusivity or struggles in a crowded premium market will depend on how CRED leverages rewards, storytelling, and brand positioning. For now, the launches reaffirm its commitment to innovation, even as profitability and market competition continue to test its resilience.