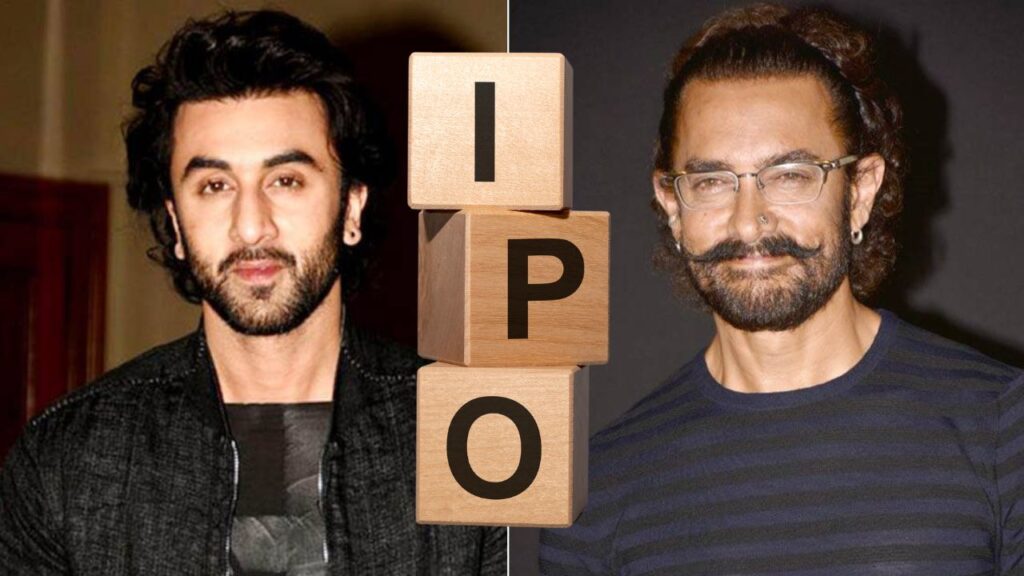

Xolopak India, a Pune-based sustainable packaging company, announced that Bollywood stars Aamir Khan, Ranbir Kapoor, and filmmaker Karan Johar have invested in the company’s pre-IPO funding round. In addition to the Bollywood celebrities, Russell Mehta, owner of Rosy Blue India and father-in-law of Akash Ambani, has also taken a minority stake in the firm. However, Xolopak did not disclose the exact amount of investment made by these prominent individuals.

Investors Join Pre-IPO Funding

The pre-IPO funding round saw participation from several other notable investors, including Devanathan Govindarajan from Riverstone Capital, Minerva Ventures Fund, Nexta Enterprises LLP, NVS Corporate Consultancy Services, Opus Software Solutions, Sarod Reality, Feroz Farms and Holdings, and Viney Equity Market LLP. These investors have joined hands to support Xolopak’s mission of creating eco-friendly disposable products.

Xolopak’s Sustainable Products

Xolopak India specializes in the manufacturing of organic and sustainable disposable packaging, including cutlery, ice cream sticks, and spoons. The company is committed to providing eco-friendly alternatives to plastic products, making them a key player in the green packaging sector. Their focus on sustainability has attracted significant interest from both investors and customers, as businesses are increasingly adopting environmentally friendly solutions.

Preparing for IPO

Recently, Xolopak India filed a Draft Red Herring Prospectus (DRHP) with NSE Emerge to raise funds through an initial public offering (IPO). The IPO will include a fresh issue of up to 52.86 lakh equity shares, with a face value of Rs 10 per share. Beeline Capital Advisors has been appointed as the sole book-running lead manager for the issue.

Xolopak Financial Growth

On the financial front, Xolopak has shown impressive growth. In FY24, the company reported a profit after tax (PAT) of Rs 6.36 crore, nearly doubling its PAT from Rs 3.48 crore in the previous fiscal year. Moreover, Xolopak’s revenue from operations grew nearly threefold, reaching Rs 31.47 crore in FY24, compared to Rs 11.87 crore in the preceding year. This strong financial performance demonstrates the company’s growing market presence and the increasing demand for sustainable packaging solutions.

With the latest round of investments and its upcoming IPO, Xolopak is well-positioned to scale its operations and continue its journey as a leading sustainable packaging manufacturer in India.